Calculate my weekly paycheck

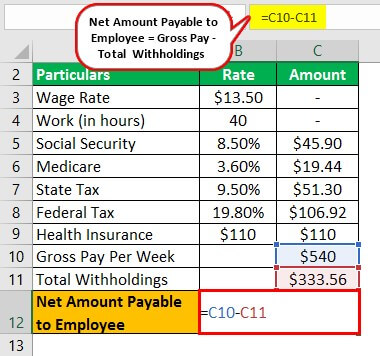

Learn what to do if your paycheck is lost stolen or damaged. This number is the gross pay per pay period.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Federal Income Tax 4233.

. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Dont want to calculate this by hand. There are 4 main filing statuses.

There are two paycheck calculators that compute paychecks for employees in Illinois and New York. 20 x 10 200. Funds can also be used to pay interest on.

Small Business Paycheck Protection Program The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury. There are five main steps to work out your income tax federal state liability or refunds. The PaycheckCity salary calculator will do the calculating for you.

He also puts 100 per paycheck toward his 401k. Learn about the benefits of this safe and fast way of getting your pay directly on your bank account. Calculate hourly and premium rates that could apply if you are paid overtime.

So his expenses 350 150 125 100 total 725 per paycheck. Subtract any deductions and payroll taxes from the gross pay to get net pay. In other words if you take home 70 of your typical paycheck as a percentage of your gross pay dont expect to receive 70 of your next one if theres a lot of overtime on it.

As an hourly employee calculating gross wages is a simple multiplication. But between state and local taxes Amir pays 350. This early loan payoff calculator will help you to quickly calculate the time and interest savings the pay off you will reap by adding extra payments to your existing monthly payment.

Firstly you will input the weeklymonthly earnings to the related sections and adjust the tax ratios for your own countrys regulations. You can multiply your hours worked by your hourly wage. Married Filing Jointly or Widower Married Filing Separately.

First add the raise to their gross wages. This number is the gross pay per pay period. Thats how much money youll need in your portfolio to produce the 50000 annual income youll need in retirement.

For example assume you work part-time 20 hours a week and earn 10 per hour. Enroll in Direct Deposit. Can I afford to take out a 15-year fixed-rate loan.

You wanna calculate something. Bill is an electrician who wants to calculate his take-home net pay. Our system allows you to run hourly employee payroll on the go from your smartphone tablet or computer all you need is internet access.

Subtract any deductions and payroll taxes from the gross pay to get net pay. You can also use the calculator to calculate hypothetical raises adjustments in retirement contributions new dependents and changes to health. Heres how to calculate gross wages if youre an hourly or salaried employee.

Pay each week generally on the same day each pay period. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk. Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid.

Enter the required information into the form to instantly get your results. Find the banks that offer free checking. The income you receive before any tax and benefit deductions is your gross income.

The PaycheckCity salary calculator will do the calculating for you. First you need to determine your filing status to understand your tax bracket. Pay every other week generally on the same day each pay period.

Pay 4 times a year. Savings retirement investing mortgage tax credit affordability. Based on that rate you can calculate the needed size of your portfolio to be 25 times your annual cost of living.

Basically this tool lets you calculate employee salary with taxes. Hes paid bi-weekly and the gross income on his paycheck reads 2115. To figure out how much the raise increases the employees weekly or biweekly gross pay you can divide the annual salary by 52 weekly 26 biweekly 24 semimonthly or 12 monthly.

The calculator also includes an optional amortization schedule based on the new monthly payment amount which also has a printer-friendly report that you can. Find your gross income. If you need help figuring out what your new monthly mortgage payments will look like try our mortgage calculator.

Our free salary paycheck calculator see below can help you and your employees estimate their paycheck ahead of time. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Pay on specified dates twice a month usually on the fifteenth and thirtieth. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. What is the value of my business.

Pay on a specified day once a month. Of course getting to that portfolio size will require a series of strategies. Follow these steps to calculate how much money youll take home each paycheck.

Is the house payment 25 or less of my monthly take-home pay. This is always included in your pay stub and is typically the stated salary in your employee contract. How Leap Year Changes your Bi-Weekly Gross.

Another 150 goes to social security and medicare. Then the rest is calculated automatically. If you are paid on an hourly or daily basis the annual salary calculation does not apply to you.

Can I afford ongoing maintenance and utilities for this home. 125 goes toward his health care premiums. Hours x Wage Gross weekly pay.

Consult a Pro to Find the Right Home. Easy and online. Calculate your paycheck in 5 steps.

This Payroll Calculator Excel Template supports as many employees as you want. SurePayroll offers all the following plus much more. Bill lives in Colorado with his wife and daughter.

The calculators allow employees to calculate paychecks for monthly semi-monthly and bi-weekly in one place which also can be used for out-of-state employees with no state taxes input 99 in the Additional Exemptions State field. Its a challenge to manage employees calculate their hourly paychecks and process your payroll all while running a small business. Check out the Frequently Asked Questions about pay.

Step 1 Filing status. Dont want to calculate this by hand. He currently makes a gross annual salary of 50000.

How to calculate your take-home pay.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Federal Withholding Tax Youtube

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

Payroll Formula Step By Step Calculation With Examples

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Net Pay Step By Step Example

Paycheck Calculator Us Apps On Google Play

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Us Apps On Google Play

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

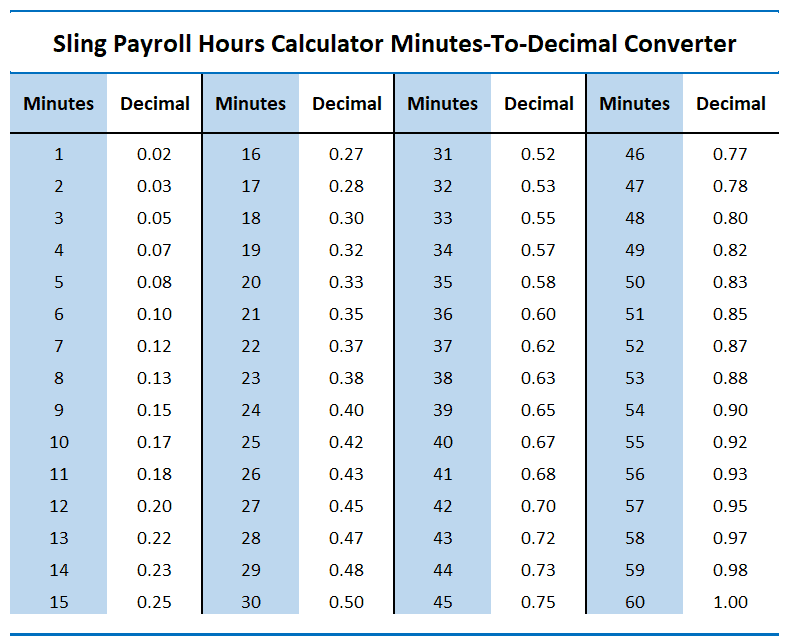

How To Calculate Payroll For Hourly Employees Sling

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet