Sep ira contribution calculator

Do not use this calculator if the business employs additional. Is SEP contribution 20 or 25.

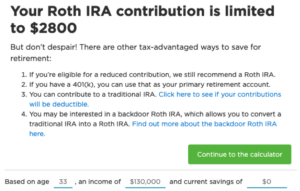

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

How do I calculate my SEP contribution.

. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. How to Calculate Self-Employment Tax. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

Self-employment tax less your SEP IRA contribution. This free SEP IRA contribution calculator is an ideal tool if youre thinking about using a SEP and want to know how much youll be able to contribute. Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans.

Individual 401 k Contribution Comparison. Ad Help Determine Which IRA Type Better Fits Your Specific Situation. For this reason SEPs are rarely chosen by those with greater than 20.

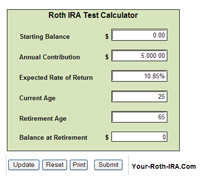

Compare 2022s Best Gold Investment from Top Providers. For comparison purposes Roth. Get Support for Your Business Needs.

SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an. Ad Save for Retirement with a SEP-IRA. The 2022 SEP IRA contribution limit is 61000 and the 2021 SEP IRA contribution limit is 58000.

How to Calculate Cost of Goods. Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP. As a self-employed person you may contribute up to 25 of your earnings to a SEP retirement account.

Reviews Trusted by Over 45000000. Most SEPs require employers to contribute to each employees plan at the same percentage of their salarywages. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

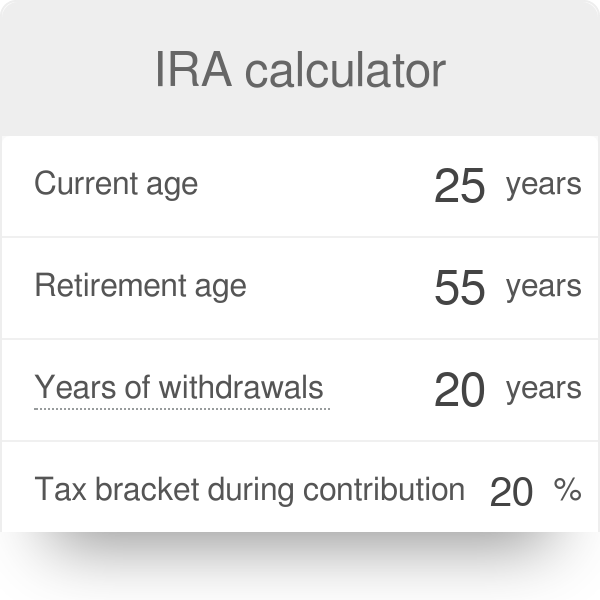

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan. As you already know a simplified.

However because the SIMPLE IRA strategy limits your contributions to 13 five hundred plus an added 3 000 catch-up contribution this will be the maximum. Contributions must be based only on the first 305000 of an employees or owners compensation for 2022. A One-Stop Option That Fits Your Retirement Timeline.

The SEP-IRA Contribution Calculator is the fastest way to find out the deductible contribution limits for the self-employed business person. For example you might decide to contribute 10 of each participants. If youre thinking about establishing a.

Retirement plan contributions are often calculated based on participant compensation. Ad Discover The Benefits Of A Traditional IRA. S corporation C corporation or an LLC taxed as a corporation For incorporated.

How to Calculate Amortization Expense. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged. If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your.

They may be able to make traditional IRA contributions to the. 23 hours agoSEP IRA contributions for 2022 can be up to the lesser of 61000 or 25 of your compensation while contributions to a traditional or Roth IRA are capped at 6000 annually. SEP IRAs for Any Business Including Sole Proprietors Who Want an Easy-to-Use Plan.

You can contribute up to 25 of an employees total compensation or a maximum of 58000 in tax. The maximum amount that you can contribute is 58000 2021 and 61000 2022. Supplementing your 401k or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones.

Unlike other plans employees cant defer their salary to make contributions to a SEP-IRA. For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for 2022 58000 for. Simply enter your name age and income and click Calculate The result will be a comparison showing the annual retirement contribution that would be permitted based on your income in.

Ad Capital Group Home of American Funds Offers User-Friendly SEP IRA Plans. Learn About 2021 Contribution Limits Today. This is up from 290000 for 2021 and 285000 for 2020.

How Simple Ira Matching Works Youtube

Sep Ira Plan Br Maximum Contribution Calculator

Sep Ira Calculator Sepira Com

How To Calculate Rmds Forbes Advisor

What You Need To Know About Simplified Employee Pensions Seps

Sep Ira Contribution Calculator For Self Employed Persons

Ira Calculator

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Ira Calculator See What You Ll Have Saved Dqydj

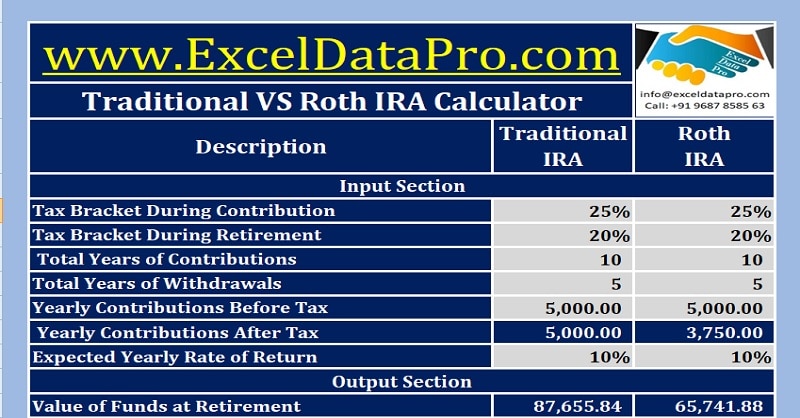

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Sep Ira Calculator Ruby Money

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

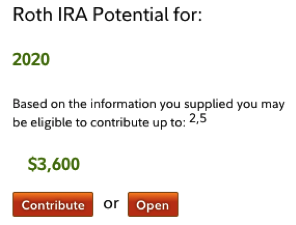

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Roth Ira Calculators

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira